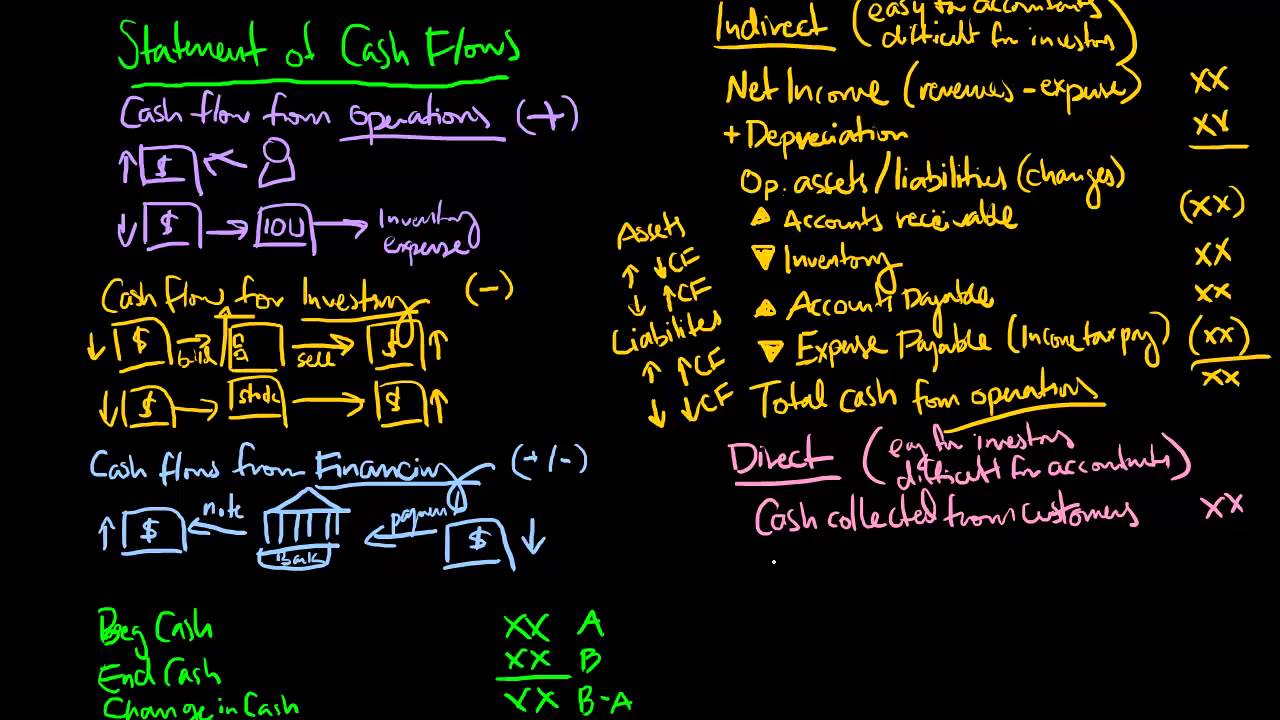

direct cash flow vs indirect cash flow

In both methods there is no difference in cash flows from investing activities and cash flows from financing activities. The formula for finding the indirect cash flow method is.

Cash Flow Statement Template Download Excel Sheet Cash Flow Statement Cash Flow Statement Template

When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income.

. Eventually youll need to switch to indirect cash flow forecasting as your company expands. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Direct Cash Flow Forecasting Zeroes in on the Ground Game.

Cash flow Net Income losses and gains from financing and investment changes in operating accounts non-cash charges. The indirect technique displays the cash flow statement as a function of changes into current assets and liabilities. Start with receipts from customers.

Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. Direct vs indirect methods of cash flow statement.

Establishes the relationship between sales and cash receipts etc. Unlike the direct approach the net profit or loss from the Income Statement is adjusted for the effect of non-cash transactions. They both will come to the same figure but via different sets of data.

The information from the operating activities is presented differently with each method. Direct cash forecasting sometimes called the receipts and disbursements method of forecasting aims to show cash movements and positions at specific future points in time. Statement of cash flows can be prepared and presented by two methods namely direct method and indirect method.

This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. The differences between direct and indirect cash flow reports.

The inputs into a direct cash forecasting process are typically upcoming. Instead throughout the quarter you closely monitor all the information that tells you what cash is coming in and going out such as. Direct and indirect methods are different only to the extent of the calculation of cash flows from operating activities cash flows from investing and financing activities are calculated in.

On the other hand direct method cash flow forecasting doesnt wait until the end of the quarter to see how your prediction matched reality. The indirect method backs into cash flow by adjusting net profit or net income with. The figure at the bottom of your report your closing bank position will be the same in both methods.

The indirect way of presenting a companys cash flow statement is based on net income or loss with non-cash revenue and expense components added to or deducted from that figure resulting in cash flow from operational activities. For Gatsby net cash flow from operations equals 415 million. The only difference between the indirect and direct cash flow methods appears when you calculate your cash flows from operations.

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Indirect Cash Flow Statement. This helps them to identify borrowing or investment opportunities.

Its the calculation that differs and it draws upon different data sources to arrive at the same result. While the indirect method uses net income as its starting point and the accrual basis of accounting the direct method uses the cash basis instead. Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business.

Such adjustments include eliminating any deferrals or accruals non-cash. The Indirect method focuses on net income and non-cash adjustments. When reporting income this only takes into account money that has actually been received by the firm meaning it directly reflects the actual cash a company has to hand and when this is.

Put simply the direct and indirect methods are both ways of calculating your net cash flows. Moreover each business is different and may prefer a certain way. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to. Alternatively the direct method begins with the cash amounts received and paid out by your business. Indirect cash flow discussion is the use of accounting software to keep things organized.

The indirect method begins with your net income. Generally companies start with direct cash flow forecasting to understand their daily cash movements. The additions and deductions listed above reconcile net income to net cash flow from operating activities illustrating the reason for referring to the indirect method as reconciliation method.

The difference lies in the presentation of cash flows from operating activities. The direct method is perhaps the simplest to understand though it is often more complex to calculate in practice. The net income is then followed by the adjustments needed to convert the accrual accounting net income to the cash flows from operating activities.

An important point in the direct vs. Direct cash forecasting is a method of forecasting cash flows and balances used for short term liquidity management purposes. The indirect method uses your net income as its base and comes to a figure by the use of adjustments.

As you can see there are a few key differences between direct and indirect cash flow methods. Here are the steps to follow when preparing a cash flow statement that uses the direct method.

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Cash Flow Statement Cash Flow Statement Cash Flow Statement Template

Direct And Indirect Cash Flow Methods Infographics Here Are The Top 7 Difference Between Direct And Indirect Cash F Cash Flow Cash Flow Statement Direct Method

Two Methods Are Available To Prepare A Statement Of Cash Flows The Indirect And Direct Methods The Financial Acco Cash Flow Statement Cash Flow Direct Method

Statement Of Cash Flows Explained Cash Flow Accounting Classes Easy Cash

Indirect Cash Flow Method Description Cash Flow Cash Flow Statement Directions

Statement Of Cash Flows Significant Non Cash Activities Bookkeeping Business Cash Flow Statement Accounting Classes

Debit And Credit Cheat Sheet Making Of Cash Flow Statement With Both Direct And Indirect Methods Bookkeeping Business Accounting Accounting Classes

Cash Flow Statement Indirect Method

Statement Of Cash Flows Indirect Accounting Cpa Exam Cash Flow

Statement Of Cash Flows Cash Flow Statement Statement Template Accounting Education

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Cash Flow Statement Statement Template Cash Flow

A Cash Flow Statement Template Is A Financial Document That Provides Valuable Information About A Cash Flow Statement Accounting Education Bookkeeping Business

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Cash Flow From Operating Activities Cfo Cash Flow Statement Cash Flow Direct Method

Operating Activities Section By Direct Method Accounting For Management Direct Method Method Directions

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Basics

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Accounting Basics

Myeducator Business Management Degree Accounting Education Accounting Classes